Recommerce is Not Secondhand News

Over $300M to fund marketplaces enabling the recommerce, resale, and circular economies around the world. And oh ya, geriatric millennials do TikTok.

It was just last week that I mentioned recommerce as a niche within ecommerce which I had previously been neglecting.

Several conversations with the founders of Treet and Archive opened my eyes to the resale economy as both brands and consumers look to own the experience, develop a community, and profit.

This week, that trend accelerated globally.

Founded in Lithuania, secondhand clothing marketplace Vinted raised $303M at a $4.5B valuation led by EQT Growth, along with previous backers Accel, Insight Partners, and Lightspeed Venture Partners participating. They now operate across 13 markets in Europe and the US, as they support over 45M users.

Based in Los Angeles, secondhand and vintage fashion marketplace Thrilling raised $8.5M led by Prelude Ventures. With close to 300 sellers today, ~95% are women and/or Black and people of color.

Rounding out the week, New York-based Kaiyo raised $5M led by Moderne Ventures for their secondhand furniture marketplace. They go beyond the traditional marketplace (today) and pick up, clean, photograph, and deliver all products sold on their platform

The circularity zeitgeist is strong.

And I guess you can teach a geriatric millennial new tricks…

The State of Ecommerce

What’s happening in the ecosystem? Who’s up? Who’s down? Who’s building the future?

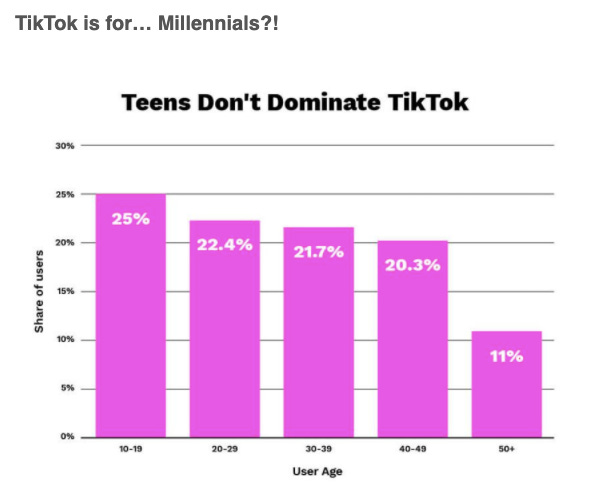

Speaking of geriatric millennials, allegedly we TikTok too: As Facebook, Instagram, and Google fight for the #2 spot behind Amazon, TikTok starts testing in-app shopping.

Advertisers are reeling to TikTok: Demand from advertisers for the ByteDance developed social network is up 325% year-over-year.

The TikTok of Ecommerce: According to Packy McCormick, the fastest-growing ecommerce company in the world is Shein, which reportedly did $10B in revenue in 2020 and has grown over 100% for each of the past eight years.

You can now buy Gucci with Robux? The metaverse is getting fashionable as you can visit the Gucci Garden in Roblox.

Instant Exchanges. Zero Risk. Along with their bonus credits and other perks to drive returns, Loop launches instant exchanges with zero risk and zero fees to complement their re-brand.

BigCommerce’s revenue growth accelerates again: Brent Bellm highlights how their bet on open, flexible SaaS for the mid-market and enterprise is paying off, as first quarter revenue jumped 41% over 2020.

Acquisitions & IPOs

Liquidity events fuel the market, drive new innovation, and create new founders with deep experience and even deeper pockets. Who’s getting acquired? And who’s going public?

Happy Returns: PayPal acquired Happy Returns for an undisclosed sum, adding the returns software and innovative returns bars to their suite of tools for the millions of websites that depend on them for payments. Former PayPal co-founder and now CEO of Affirm, Max Levchin, acquired Returnly last month.

MGM: As the content wars heat up and Amazon tries to eat the world, they have their sights set on the 97-year-old media company.

Bouncer: Shortly after acquiring TaxJar, Stripe buys fellow YC-backed Bouncer, a card authentication and fraud detection tool founded two years ago.

Zeekit: Following the Rise.ai acquisition by Wix, fellow Israeli-based virtual clothing try-on startup Zeekit has been acquired by Walmart.

GoodRx: As Austin battles with Miami on who can #trend harder with their 0% state-income taxes, Austin-based RxSaver has been acquired by GoodRx.

Club Monaco: Ralph Lauren has officially sold Club Monaco to a private equity firm. I think that makes my CM topcoat less trendy. Kind of TBD. Will keep you posted.

Squarespace: At $700M in ARR, the New York-based website builder that started focusing on ecommerce several years ago has registered for its direct listing, which could hit the markets as early as today. They have processed ~$4B in GMV, which was up 91% from 2019.

1stDibs: With $82M in revenue and $250M in funding, the luxury online marketplace is calling dibs on Nasdaq.

JD Logistics: JD.com’s logistics subsidiary is preparing for an IPO in Hong Kong that could value the company at $34B.

I had no idea you could milk an oat: Backed by the Blackstone Group, Oprah, and Jay-Z, the Swedish oat milk company Oatly is looking to IPO at a nearly $10B market cap.

Following the Money

Who are VCs betting on to lead the future of ecommerce?

Klaviyo: Closing in on decacorn status, Klaviyo adds $320M led by Sands Capital to the $200M they raised six months ago to own ecommerce email marketing.

Pine Labs: The India-based merchant commerce platform raised $285M bringing their valuation to $3B.

Extend: Backed by SoftBank and achieving unicorn status, Extend, which makes it easier for businesses to offer product warranties, raised $260M as they expect revenue to jump 400% YoY.

GoldBelly: The online marketplace for regional and artisanal foods, GoldBelly raised $100M in their Series C led by Spectrum Equity.

Knix: Crossing $100M in revenue, the women’s underwear and apparel brand raises $53M in funding.

RallyRoad: My first “investment” on RallyRoad (now going by Rally) was an ‘85 Ferrari Testarossa in 2017. My most recent was a Mosasaur skeleton. I guess that was all Accel needed to hear, as they led the $30M Series B round.

Liquid Death: To murder your thirst, the cult favorite Liquid Death has raised $15M with their Live Nation exclusive deal.

Bosta: With plans to deliver more than 15M packages in Egypt for over 20,000 brands in the next two years, Bosta raised $6.7M led by Silicon Badia.

Companies to Watch

Each week, I’ll highlight a couple companies in the ecommerce technology and brand space that stand out to me. If you have suggestions, please reply to my email or DM me (in fact, one of the companies being featured next week came from a DM).

Ecommerce Technology

The collaborative commerce platform that allows brands to cross-sell and partner in minutes, Honeycomb is a company to watch. Their Ledbury case study nailed it when the premium shirtmaker and menswear brand found their industry seemingly changed overnight from luxury to business casual. Equally as fast, Ledbury was able to partner with brands like Criquet and Myles Apparel to expand their catalog and attract a new type of buyer. As traditional digital channels become more expensive and brands need to partner faster, will this be the next recommerce?

Ecommerce Brands

I am cheating here, but you have to check out The Irish Pub Company, which has sold over 2,000 “pubs in a box” to bar owners in 60 countries. I wonder if they can outfit a spare bedroom.

In Closing

Appreciate you all subscribing last week and many of you hitting me up directly. Now go back to figuring out how you’re going to buy your own pub in a box.

Best,

Another solid post. I'm already thinking of what to do to get a mention ;-)